ev charger tax credit california

Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive. Southern California is also home to Anaheim Public Utilities which offers some of the best EV charging rebates for commercial customers.

And while it is a non-refundable credit ie.

. In addition to local incentives the federal rebate for electric cars applies to all fifty states. Reduced Vehicle License Tax and carpool lane access. Replace your older high-polluting vehicle with a hybrid or electric vehicle and you could be eligible to receive up to 9500.

An income tax credit is available for 50 of the cost of alternative fueling infrastructure up to 5000. As an approved vendor under many California EV charging incentive programs EV Connect will provide end-to-end solutions such as. Over 9000 in California EV rebates and EV tax credits available.

CPCFA Summarizes Sunset of Program Effective March 31. Additional incentives could be available in your ZIP code. While the national EV charger tax credit ran out at the end of 2021 some utilities have introduced their own rebates and incentives.

Ad Find the right EV Charger for your Home or Business. The goal of the CalCAP Electric Vehicle Charging Station Program was to expand the number of electric vehicle charging stations installed by small businesses in California. Ad Offering the best-in-class products services starting at 350.

Qualifying infrastructure includes electric vehicle supply equipment and equipment to dispense fuel that is 85 or more natural gas propane or hydrogen. Southern California Edisons Pre-Owned EV Rebate Program offers customer a 1000 rebate for the purchase or lease of an eligible used EV. The program was funded through the California Energy Commission and operated from June 1 2015 through March 31 2022.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. After the base 2500 the tax credit adds 417 for a 5-kilowatt-hour battery. If you have any questions read our FAQ section.

FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED. Note that the federal EV tax credit amount is affected by your tax liability. Theres an EV for Everyone.

What more could you want in a charger. However the credit is worth up to 7500 depending on the size of the battery. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station.

Current EV tax credits top out at 7500. As of mid-2022 for example Sonoma Clean Power is offering customers a Level 2 EV Charging incentive. More incentives rewards rebates and EV tax credits are available to people who purchase or lease qualifying Battery Electric BEV or Plug-in Hybrid PHEV vehicles including utility discounts on chargers and electricity rates.

In California electric vehicle tax credits and incentives are readily available. SRP and APS offer reduced electricity rates based on time-of-use charging for EV owners. The BBB EV tax credit provisions may still influence current efforts to update the incentive so here are the provisions that were.

Electric Vehicles Solar and Energy Storage. The Build Back Better Act which would have increased the maximum electric vehicle tax credit to 12500 was defeated in Congress. See a list at DriveClean Electric for All and.

The program is limited to vehicle owners residing in the jurisdiction of the South Coast Management District who meet the income and vehicle requirements. Ad Discover The Best EV Charging Station Incentives Rebates 247 Support Easy Paperwork. Can you receive an EV charger tax credit when you install an electric vehicle charger.

EV tax credit for new electric vehicles. Charging stations software 247 support and parts and labor warranty. Find the right one today.

Answer Simple Questions About Your Life And We Do The Rest. As of December 2019 California has 22233 electric vehicle charging outlets including 3355 direct current fast chargers at over 5674 public stations throughout the state. This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence.

It cannot be used to increase your overall tax refund it is still a. For every kilowatt-hour of capacity above 5 kilowatt-hours the credit goes up by 417 capping out at 7500. For example if you purchase an EV eligible for 7500 but you owe only 4000 in taxes you will receive a 4000 credit.

Top customer service 3-year warranty universal. Tucson Electric Power offers a rebate of up to 300 as a bill credit for residential charger installation. No Tax Knowledge Needed.

Explore workplace EV charging incentives. Utility-sponsored incentives change often as they receive and run out of funding quickly. The states goal is to have 1500000 zero-emission vehicles on the road and 250000 charging outlets.

Compare electric cars maximize EV incentives find the best EV rate. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure. Included are EVSE tax credits and Level 2 EV charging rebates as well as rebates for electric cars.

Up to 1000 state tax credit Local and Utility Incentives. If you go with an all-electric vehicle the odds are higher that youll. Heres how to find out and what the federal and state incentives for installing commercial EVs look like.

Find the right EV charging Solution for your Home. As an approved vendor across multiple programs and.

What Are The Ev Charger Levels

How To Get More Level 2 Ev Charging Flexibility Without Costly Electrical Work

Do I Have To Pay To Charge My Electric Car Autotrader

U S Proposes Standards For Fast Electric Vehicle Charging Projects Reuters

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HQQMXXLMTJJS5FTFRXCEUQNDSE.jpg)

White House Says Companies Investing 700 Million To Boost Ev Charger Production Reuters

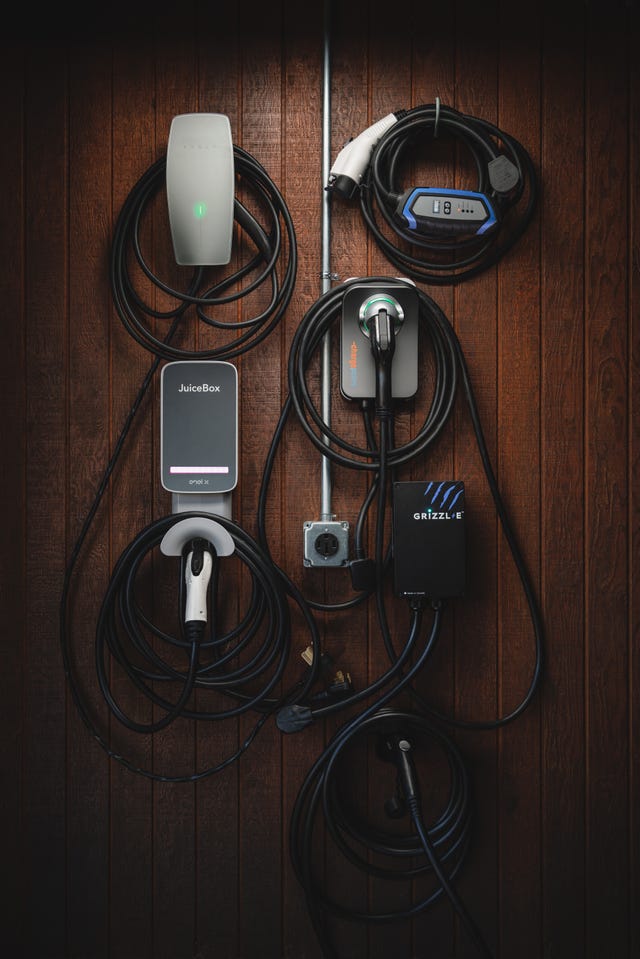

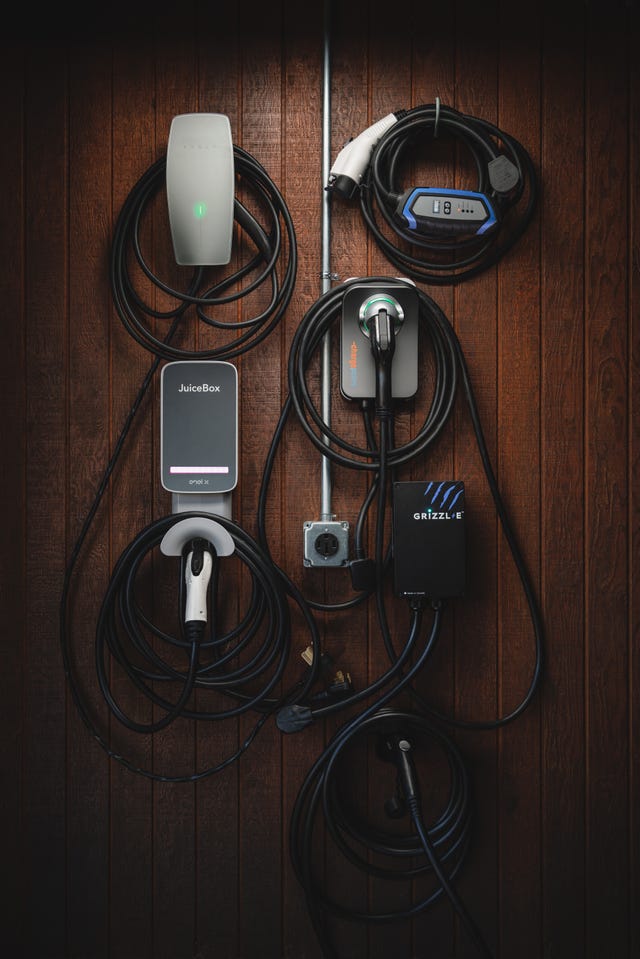

Best Ev Chargers For 2022 Tested Car And Driver

Axfast 32amp Level 2 Electric Vehicle Charger Costco

Rebates And Tax Credits For Electric Vehicle Charging Stations

The Future Of Ev Charging Post Covid 19 New Technology Helps Make Charging Easier Profitable Auto Futures

Nyc Unveils Plan For Ev Charging Network Transport Topics

U S Proposes Standards For Fast Electric Vehicle Charging Projects Reuters

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Ev Charging S Impact On Multifamily Communities Enel X

Commercial Ev Charging Station Installation Tca Electric

Tax Credit For Electric Vehicle Chargers Enel X Way

Dot Will Pay States To Build Out A Massive Ev Charging Network

Not Nearly Enough Money For Ev Charging In The Infrastructure Bill